Whether you are buying or

selling a home, it can be quite an adventurous journey. This is why you need an experienced real estate professional to guide you on the path to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or

FSBO.

The 5 reasons you NEED a real estate professional in your corner haven’t changed, but have rather been strengthened by the projections of higher mortgage interest rates & home prices as the market continues to pick up steam.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true real estate professional is an expert in his or her market and can guide you through the stacks of

paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what?

There are over

180 possible steps that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to make sure that you achieve your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. After looking at the list of parties that you will need to be prepared to negotiate with, you’ll soon realize the value in selecting a real estate professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are

at least 11 different people who you will need to be knowledgeable of, and answer to, during the process.

4. What is the home you’re buying/selling really worth?

It is important for your home to be

priced correctly from the start to attract the right buyers and shorten the amount of time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to a

study by

Collateral Analytics, FSBOs achieve prices significantly lower than those from similar properties sold by real estate agents:

“FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.”

Get the most out of your transaction by hiring a professional.

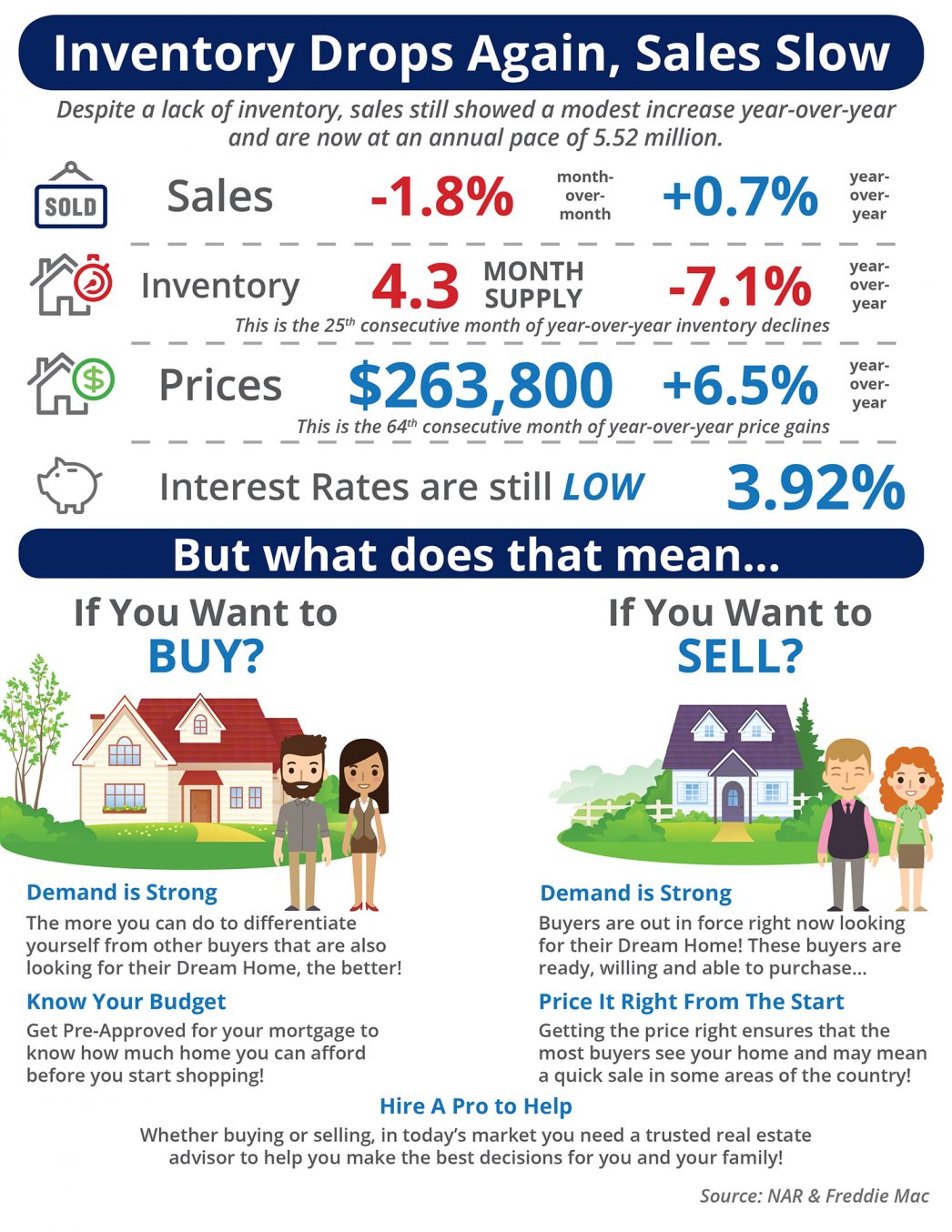

5. Do you know what’s really going on in the market?

There is so much information out there on the news and on the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively and correctly price your home at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has his or her finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

You wouldn’t replace the engine in your car without a trusted mechanic. Why would you make one of the most important financial decisions of your life without hiring a real estate professional?

![Top 4 Home Renovations for Maximum ROI [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/11/14114554/20171117-Renovations-STM-1046x1354.jpg)

![Top 5 Reasons Why Millennials Choose to Buy [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/09/08111957/Millennials-Choose-to-Buy-STM-1046x1354.jpg)

![The Cost of Renting vs. Buying in the US [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/06/20140414/20170623-Rent-vs.-Buy-STM-1046x1354.jpg)

![Top Home Renovations for Maximum ROI [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/06/16125643/20170616-Renovations-STM2-1046x1354.jpg)

![Why Americans Consider Moving to Another State? [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/05/12162610/Why-Americans-Move-STM-1046x1354.jpg)

![Homes are Selling Fast Across the Country [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/04/25170948/20170428-Days-on-the-Market-STM-1046x1354.jpg)

![Is Your First Home Within Your Grasp? [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/04/11134052/FTHB-Demographics-STM-1046x1477.jpg)

![Why Millennials Choose to Buy [INFOGRAPHIC] | MyKCM](https://d8yi0qr1xsq5x.cloudfront.net/2017/03/23122033/Millennials-Choose-to-Buy-STM-1046x1354.jpg)