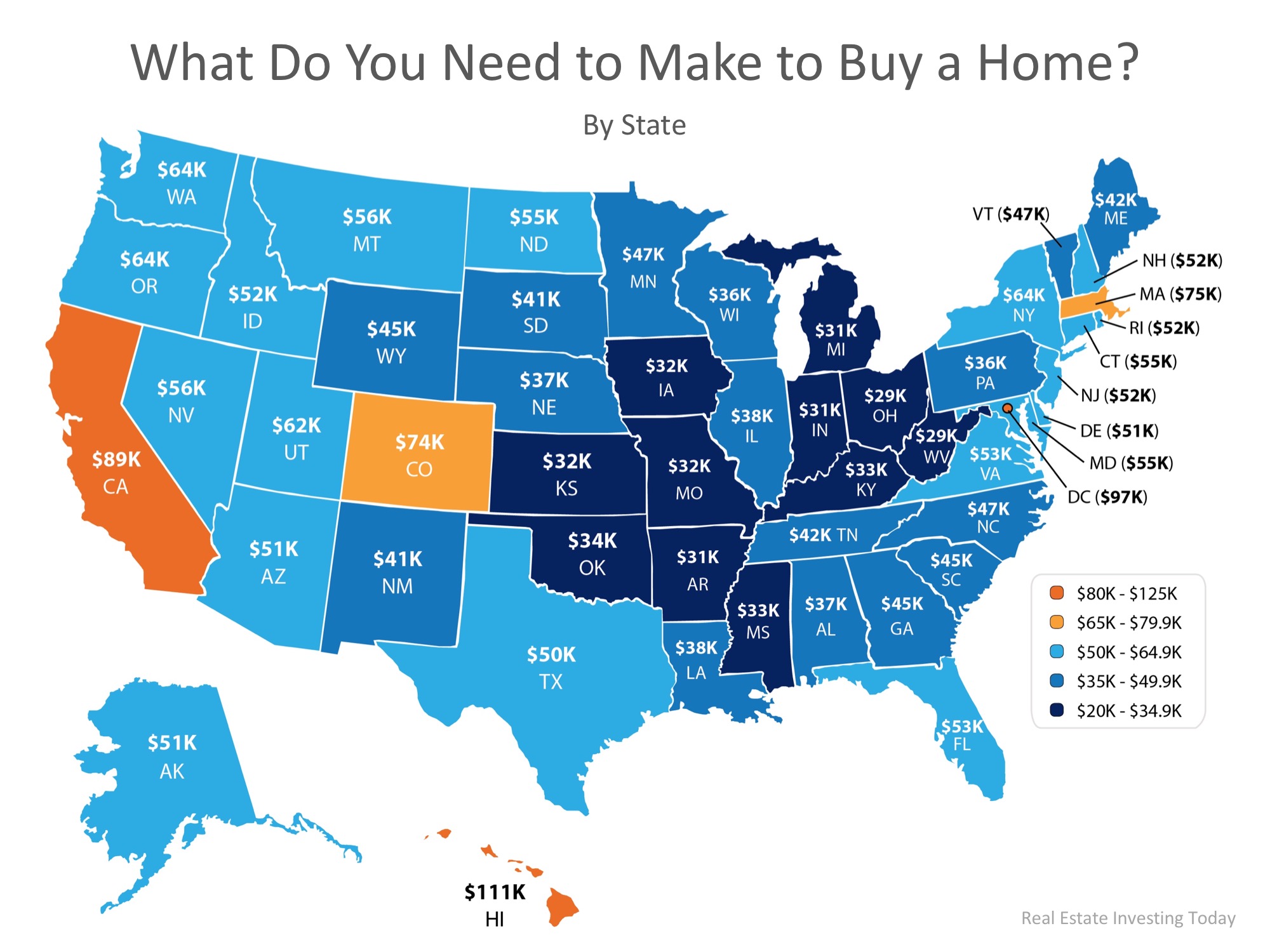

It’s no mystery that cost of living varies drastically depending on where you live, so a new study by GOBankingRates set out to find out what minimum salary you would need to make in order to buy a median-priced home in each of the 50 states, and Washington, D.C.

States in the Midwest came out on top as most affordable, requiring the smallest salaries in order to buy a median-priced home. States with large metropolitan areas saw a bump in the average salary needed to buy with California, Washington, D.C., and Hawaii edging out all others with the highest salaries required.

Below is a map with the full results of the study:

GoBankingRates gave this advice to anyone considering a home purchase,

“Before you buy a home, it’s important to find out if you can afford the monthly mortgage payment. To do this, some financial experts recommend your housing costs — primarily your mortgage payments — shouldn’t consume more than 30 percent of your monthly income.”

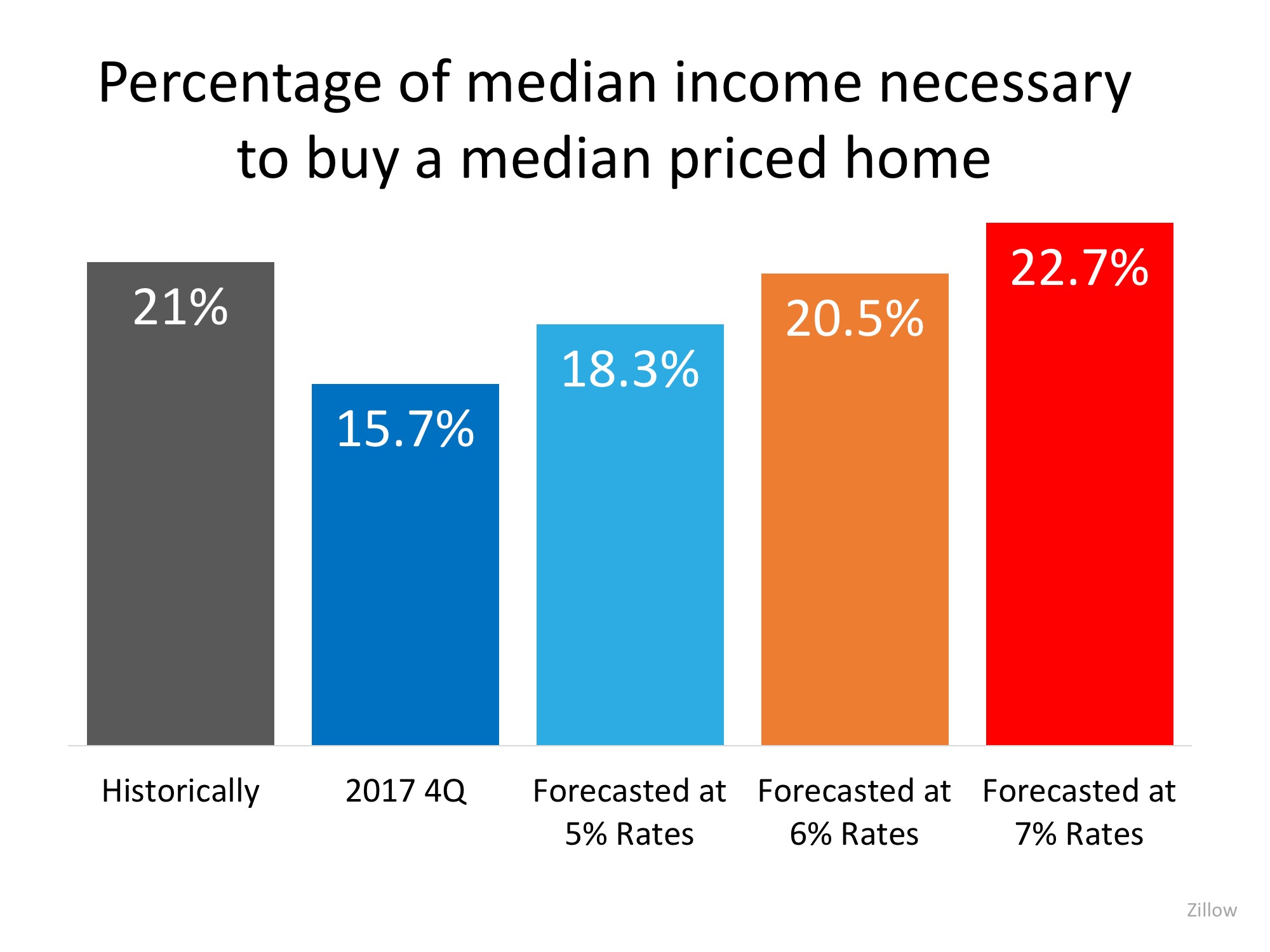

As we recently reported, research from Zillow shows that historically, Americans had spent 21% of their income on owning a median-priced home. The latest data from the fourth quarter of 2017 shows that the percentage of income needed today is only 15.7%!

Bottom Line

If you are considering buying a home, whether it’s your first time or your fifth time, let’s get together to evaluate your ability to do so in today’s market!