When thinking about selling their house, homeowners have many options. A relatively new option is using an “iBuyer.” What is an iBuyer?

According to Jovio, the definition is:

“A company or investor that uses Automated Valuation Models (AVMs) to make instant offers on homes. It allows sellers to close on a property quickly. Once sold, the company then turns around and resells the home for a profit.”

Today, there are many iBuyer companies such as OfferPad, Zillow Offers, Knock, Opendoor, and Perch. Even some more traditional companies offer the same or similar services (ex. Keller Williams, Redfin, Realogy). Ivy Zelman reported in her ‘Z’ Report that some traditional brokers are partnering with some of the larger iBuyers too:

“Keller Williams announced a partnership with Offerpad, aligning the largest franchise-based brokerage brand in the U.S. with the five-year-old iBuyer. The move follows Realogy’s partnership with Home Partners of America last year as an established brokerage player more directly providing an iBuyer alternative…

Likewise, in early July, Redfin and Opendoor announced a partnership, starting in Phoenix and Atlanta – aligning interests of the 13-year old, tech-enabled and value-focused brokerage with the largest and longest-standing iBuyer. Outside of these larger scale alliances, Zillow’s strategy has been to work with local brokerages as partners on a market-by-market basis.”

Does it make sense to sell your home to an iBuyer?

It depends.

Collateral Analytics recently released a

study which revealed the advantages and disadvantages of using an iBuyer. According to the study, if the homeowner is looking for the convenience of a quick sale with less uncertainty, using an iBuyer may make sense.

“iBuyers offer quicker closings for sellers who would like to avoid the uncertainty of knowing when and if their home will sell. For motivated sellers who want a predictable sale date and need to move, perhaps a long distance from the current location, there is no question that iBuyers have provided a welcome alternative to traditional brokerage.”

The study, however, also showed there is a cost for that convenience. Collateral Analyticsexplained:

“Traditional brokers fees generally range from 5% to 7% of the sales price…In addition to this cost, buyers typically pay some closing costs including lender related charges in the range of 1% to 3%.”

In contrast:

“iBuyers charge sellers a ‘convenience fee’ of 6% to 9.5%, some also charge the seller for fees typically paid by buyers at closing adding another 1% or more. Most iBuyers will inspect the home, assess a generous home repair allowance and negotiate a (an additional) credit to handle such repairs…Overall the total direct costs, ignoring repair credits, will run 7% to 10% for an iBuyer, versus the typical 5% to 9% combined seller and buyer costs with a traditional broker. Yet, that is not the end of the story or comparison.”

The study went on to explain how iBuyers need to charge even more because they have additional expenses beyond that of the traditional broker. They include:

- Carrying costs involving significant amounts of capital – The iBuyer must pay the expenses of the house between the time they purchase it and the time they sell it to a new buyer.

- Safeguarding the home risks – A home with an iBuyer ‘For Sale Sign’ alerts anyone passing that the house is vacant. The study suggests that these homes could become targets for vagrants and criminals.

- Adverse selection risks – The study explains that since iBuyers use computer models to determine their offer, they may be unaware of certain challenges in the neighborhood that could adversely impact the value.

- Potential home price declines – As the survey states:

“A downturn in home prices, not forecast by the iBuyer market analysts could be devastating as they ramp up their business platforms, particularly if the cost of capital increases. At the same time, downturns are precisely when the most sellers would want this option.”

Bottom Line

After taking a thorough look at the iBuyer platform, the study concludes that using an iBuyer is more expensive for the homeowner than the traditional brokerage model, but for some sellers, it may still make sense:

“These preliminary empirical results suggest that sellers are paying not just the difference in fees of 2% to 5% more than with traditional agencies, and a generous repair allowance, but another 3% to 5% or more to compensate the iBuyer for liquidity risks and carrying costs. In all, the typical cost to a seller appears to be in the range of 13% to 15% depending on the iBuyer vendor. For some sellers, needing to move or requiring quick extraction of equity, this is certainly worthwhile, but what percentage of the market will want this service remains to be seen.”

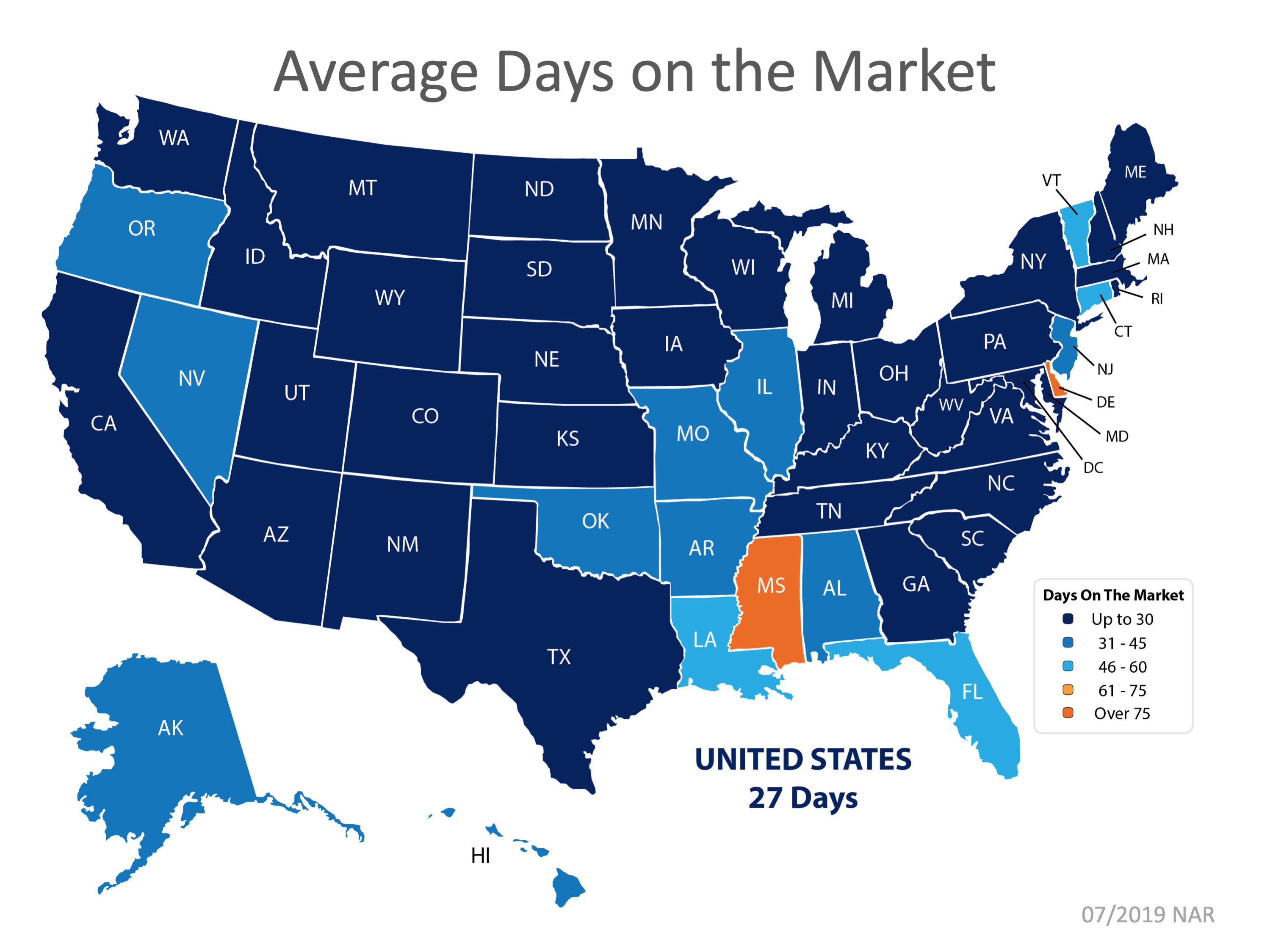

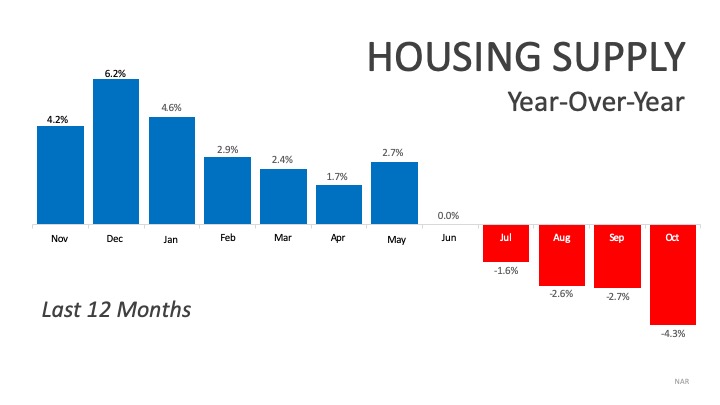

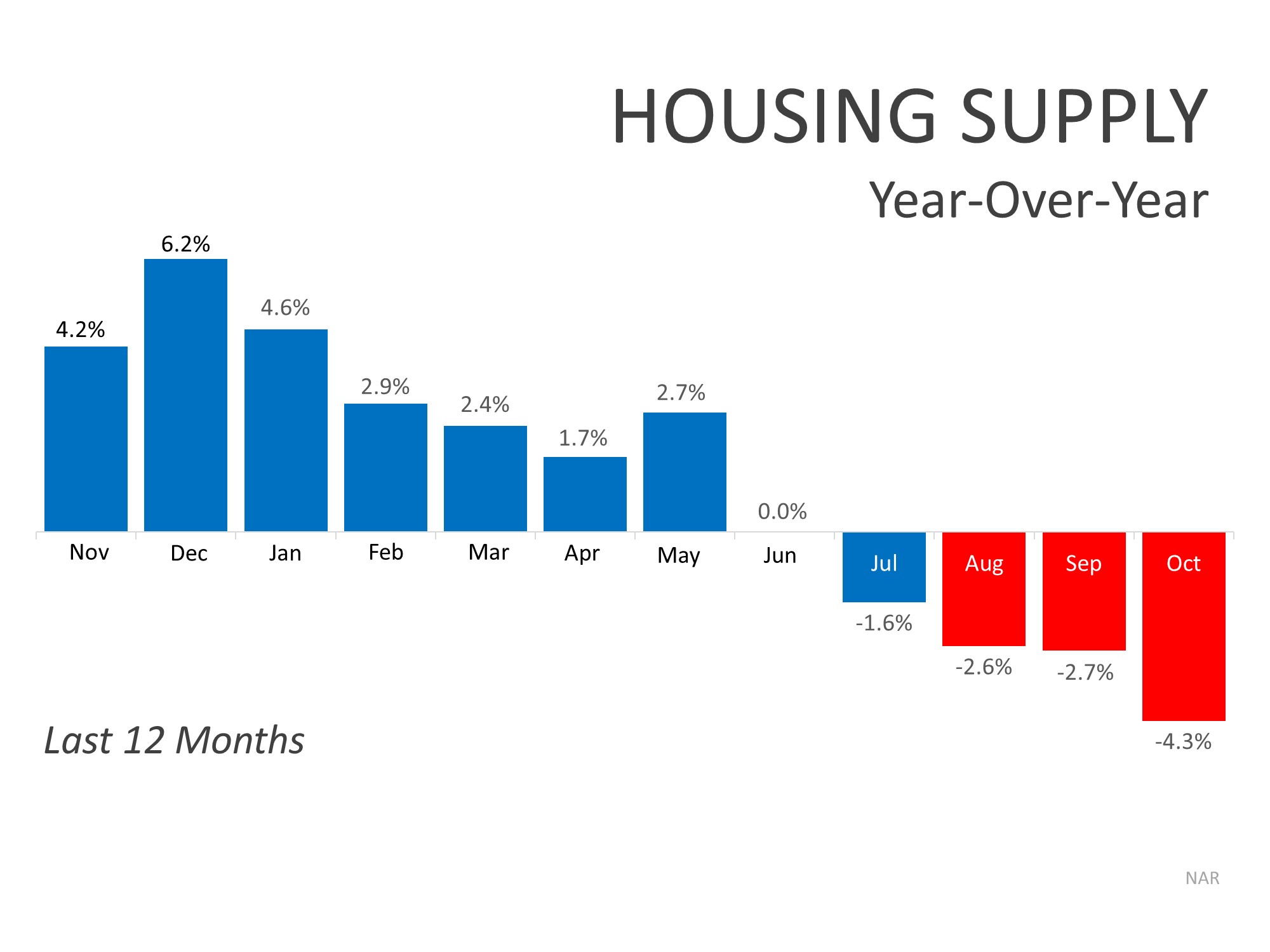

As depicted above, the percentage of available inventory has fallen for four consecutive months when compared to the previous year. So, what does this mean? If you’re a buyer, be sure to get pre-approved for a mortgage and be ready to make a competitive offer, so you can move quickly. Chances are, homes high on your wish list are likely going to go fast.

As depicted above, the percentage of available inventory has fallen for four consecutive months when compared to the previous year. So, what does this mean? If you’re a buyer, be sure to get pre-approved for a mortgage and be ready to make a competitive offer, so you can move quickly. Chances are, homes high on your wish list are likely going to go fast.

![The Cost of Renting vs. Buying a Home [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/11/13082324/20191115-MEM-ENG.jpg)

![Buying a home can be SCARY…Until you know the FACTS [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/22080625/20191025-MEM-1046x667.jpg)

![Homes Are Selling Quickly [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/16130732/20191018-KCM-Share.jpg)

![Homes Are Selling Quickly [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/16130700/20191018-MEM.jpg)

![What You Need to Know About the Mortgage Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/02093258/20191011-MEM-1046x1723.jpg)

![Rent Vs. Own [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/08/07132307/20190809-MEM-1046x1210.jpg)